keep in mind javascript is required for full website functionality.

Welcome back to our regular blog of Excel functions from A to Z. Today we look at the COUPDAYSNC function.

The COUPDAYSNC function

Coupon bonds pay interest at regular intervals, either a, two or four times a year. In excel, you can use the COUPDAYSNC function to calculate the number of knockin days del ssettlement date at Northext Cdeparture date.

The COUPDAYSNC The function has the following arguments:

- settlement: this represents the settlement date of the security. The settlement date of the security is the date after the issue date when the security is traded with the buyer.

- maturity: this is the expiration date of the security, namely when security expires

- frequency: The number of coupon payments per year. For annual payments, frequency it is 1; for semester, frequency it is 2; for quarterly, frequency it is 4. These are the only options (look down)

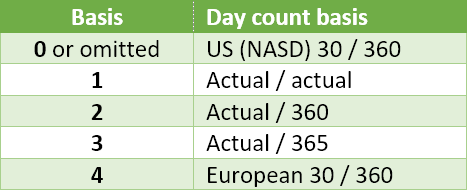

- base: the type of day count base to use. This is optional. There are five options:

It should also be noted that:

- Microsoft Excel stores dates as sequential serial numbers so they can be used in calculations. By default, the 1 of January of 1900 is the serial number 1 and the 1 of January of 2008 is the serial number 39448 because it is 39,448 days after 1 of January of 1900.

- dates must be entered using the DATE function, or as a result of other formulas or functions. For instance, use = DATE (2020,2,29) for him 29th February 2020. Problems can arise if dates are entered as text

- the settlement date is the date a buyer purchases a coupon, as a bonus. The expiration date is the date a coupon expires. For instance, Suppose a bond is issued to 30 years the 1 of January of 2008 and a buyer buys it six months later. The issue date would be 1 of January of 2008, the settlement date would be 1 July 2008 and the expiration date would be 1 of January of 2038, 30 years after the date of issue of the 1 of January of 2008

- all arguments are truncated to integers

- And settlement O maturity is not a valid date, COUPDAYSNC return the #VALUE! error value

- And frequency is any number other than 1, 2 O 4, COUPDAYSNC return the #ON ONE! error value

- And base <0 o si base > 4, COUPDAYSNC return the #ON ONE! error value

- And settlement ≥ maturity, COUPDAYSNC return the #ON ONE! error value.

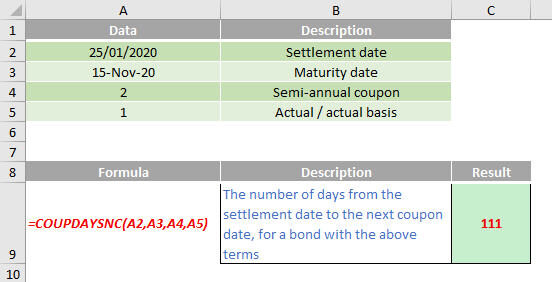

Please, see my example below:

Soon we will continue with our functions from A to Z of Excel. Keep checking: there is a new blog post every other business day.

Sign up to receive our newsletter