keep in mind javascript is required for full website functionality.

Welcome back to our regular blog of Excel functions from A to Z. Today we look at the DTO function.

La función DISC

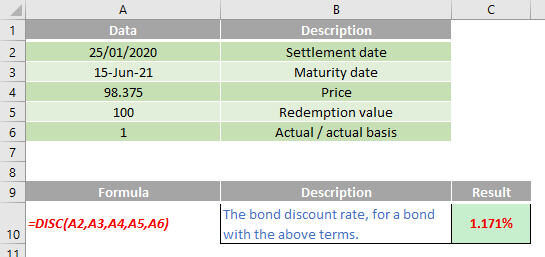

La tasa de descuento es la tasa de interés que se cobra por los préstamos y también se refiere a la tasa de interés utilizada en el análisis de flujo de efectivo descontado para determinar el valor presente de los flujos de efectivo futuros. Esta función devuelve la tasa de descuento de un valor.

The DTO The function uses the following syntax to operate:

DISC (liquidation, expiration, pr, redención, [basis])

The DTO The function has the following arguments:

- settlement: esto es obligatorio y representa la fecha de liquidación del valor. The settlement date of the security is the date after the issue date when the security is traded with the buyer.

- maturity: this is also necessary. Esta es la fecha de vencimiento del valor. La fecha de vencimiento es la fecha en que expira el valor.

- pr: nuevamente requerido. Esto denota el precio del valor por valor nominal de $ 100

- redención: required. Este es el valor de rescate del título por valor nominal de $ 100

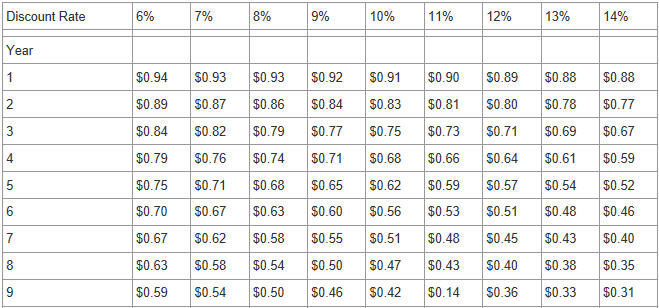

- base: this argument is optional. Este es el tipo de base de recuento de días que se debe utilizar.

It should also be noted that:

- Microsoft Excel stores dates as sequential serial numbers so they can be used in calculations. By default, the 1 of January of 1900 is the serial number 1 and the 1 of January of 2008 is the serial number 39448 because it is 39,448 days after 1 of January of 1900.

- the settlement date is the date a buyer purchases a coupon, as a bonus. The expiration date is the date a coupon expires. For instance, Suppose a bond is issued to 30 years the 1 of January of 2008 and a buyer buys it six months later. The issue date would be 1 of January of 2008, the settlement date would be 1 July 2008 and the expiration date would be 1 of January of 2038, 30 years after the date of issue of the 1 of January of 2008

- settlement, maturity Y base they are truncated to integers

- And settlement O maturity no es un número de fecha de serie válido, DTO return the #VALUE! error value

- And pr ≤ 0 o si redención ≤ 0, DTO return the #ON ONE! error value

- And base <0 o si base > 4, DTO return the #ON ONE! error value

- And settlement ≥ maturity, DTO return the #ON ONE! error value

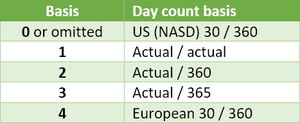

- DTO is calculated as follows:

where:

- B = número de días en un año, dependiendo del año base

- DSM = número de días entre settlement Y maturity.

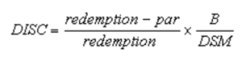

Please, see my example below:

Soon we will continue with our functions from A to Z of Excel. Keep checking: there is a new blog post every business day.

You can find a full page of feature articles here.

Sign up to receive our newsletter