keep in mind javascript is required for full website functionality.

Welcome back to our regular blog of Excel functions from A to Z. Today we look at the CUMIPMT function.

The CUMIPMT function

This function returns the accrued interest paid (“accrued interest payment”) on a loan between a start_period Y end_period given a constant periodic discount rate.

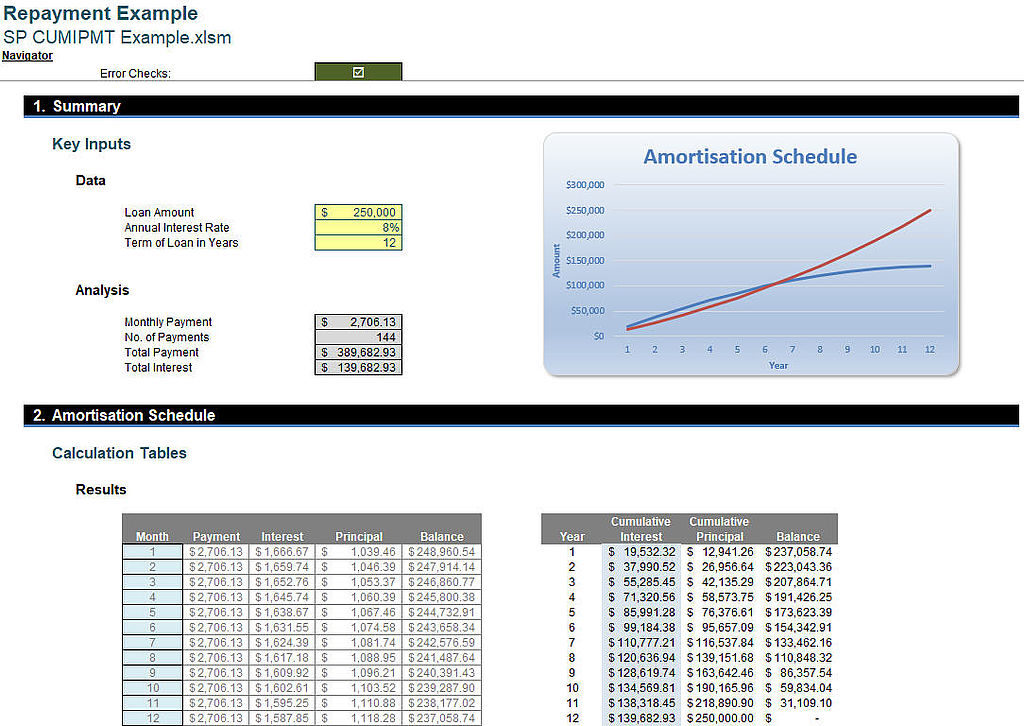

The example illustrated above can be downloaded here.

The CUMIPMT The function uses the following syntax to operate:

CUMIPMT (rate, nper, pv, start_period, end_period, type)

The CUMIPMT The function has the following arguments:

- Speed: this is required and represents the interest rate

- nper: this is also required and represents the total number of pay periods

- pv: this is mandatory and represents the present value of the amount under financing

- start_period: is mandatory and represents the first period of the calculation. Pay periods are numbered starting with 1

- end_period: this is mandatory and represents the last period in the calculation

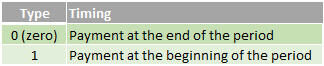

- writes: this is mandatory and represents the time of payment.

It should also be noted that:

- makes sure to be consistent with the units you use to specify the rate and nper. If you make monthly payments on a four-year loan at an annual interest rate of 10%, use 10% / 12 for rate and 4 * 12 to nper. If you make annual payments on the same loan, use el 10% for rate and 4 to nper

- And Speed ≤ 0, nper ≤ 0, O pv ≤ 0, CUMIPMT return the #ON ONE! error value

- And start_period <1, end_period <1, O start_period > end_period, CUMIPMT return the #ON ONE! error value

- And writes is any number other than 0 O 1, CUMIPMT return the #ON ONE! error value.

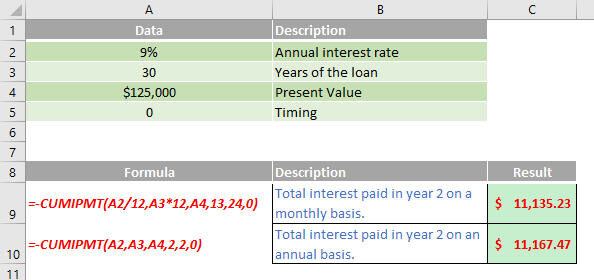

Please, see my example below:

Other key points:

- to get a monthly rate, divide the interest rate by 12 (the number of months in a year) and multiply the years the money is paid for 12 to get the amount of payments

- and Excel Online, to see the result in its proper format, select the cell and then on the ‘Home tab’ and in the group 'Number', click the arrow next to 'Number format’ and select 'General'.

Soon we will continue with our functions from A to Z of Excel. Keep checking: there is a new blog post every business day.

You can find a full page of feature articles here.

Sign up to receive our newsletter